Investment Holdings

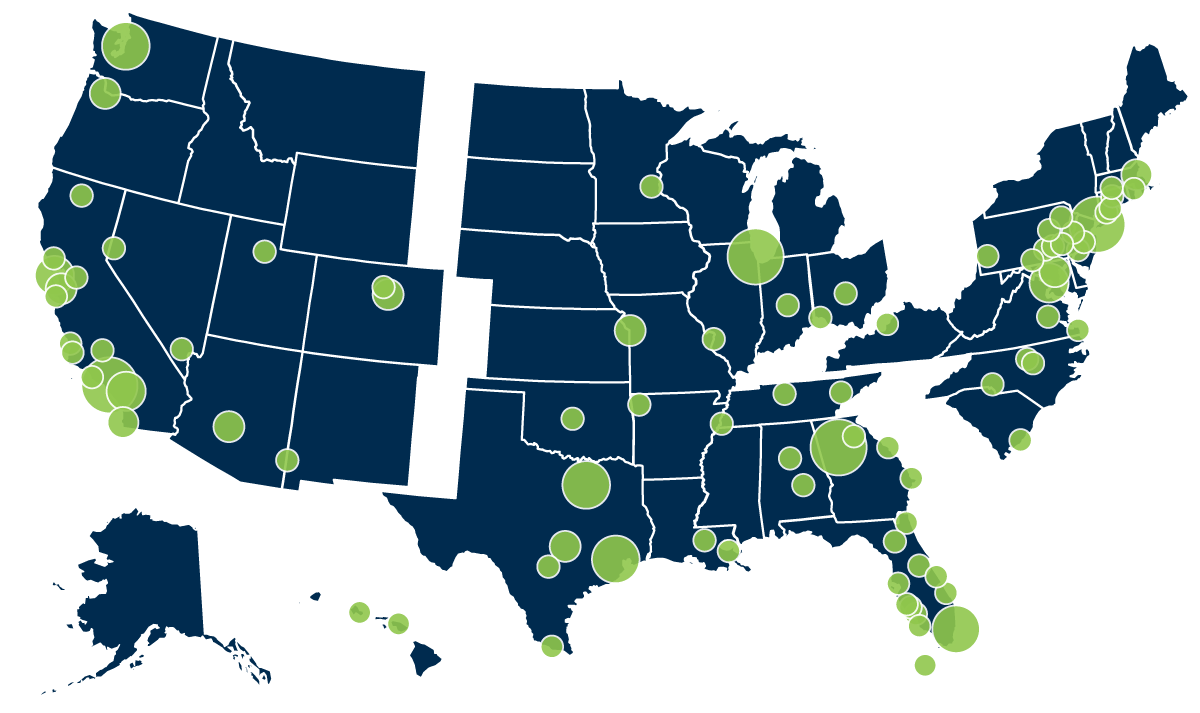

Fund Assets Under Management: $5.03 Billion

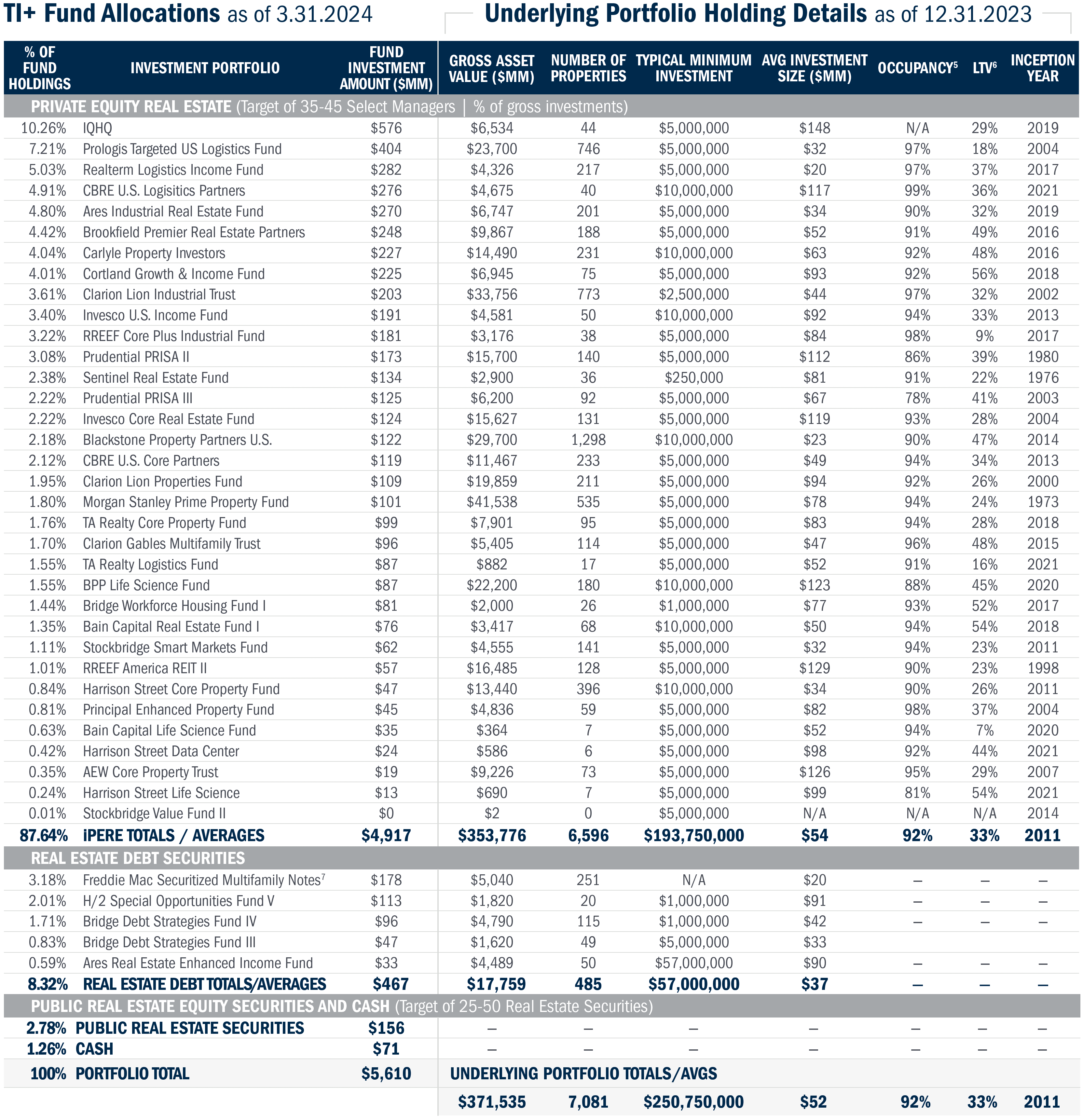

Exposure to Underlying Portfolio: One of the Largest Diversified Institutional Real Estate Portfolios

Bluerock Total Income+ Real Estate Fund (“Fund”) pursues its objectives by diversifying through a multi-manager, multi-strategy, and multi-sector investment approach.* To date, the Fund has made investments into underlying securities that collectively include: